July 2025 Market Wrap: Property Prices Are Still Rising — And Supply’s Still Not Coming

We’ve passed the halfway mark in 2025, and two things are clearer than ever:

Housing prices are still rising — modestly but steadily

Construction activity remains far too weak to ease affordability

This month’s data from Cotality (formerly CoreLogic) confirms the above statements.

Australia’s property market isn’t overheating — but it’s definitely not cooling either. That’s largely because we’re still not building enough homes.

If you’re a buyer, renter, investor, or homeowner trying to figure out what’s next, here’s what the July data is really telling us.

📈 What’s Happening in the Residential Market (Cotality Home Value Index – July 2025)

According to Cotality’s National Home Value Index:

📊 July marked the 6th consecutive month of national growth

🏙 Sydney values rose 0.6% — the same as June — with houses driving most of the gains

🧱 Nationally, house values rose 1.9% over the past 3 months, vs. 1.4% for units

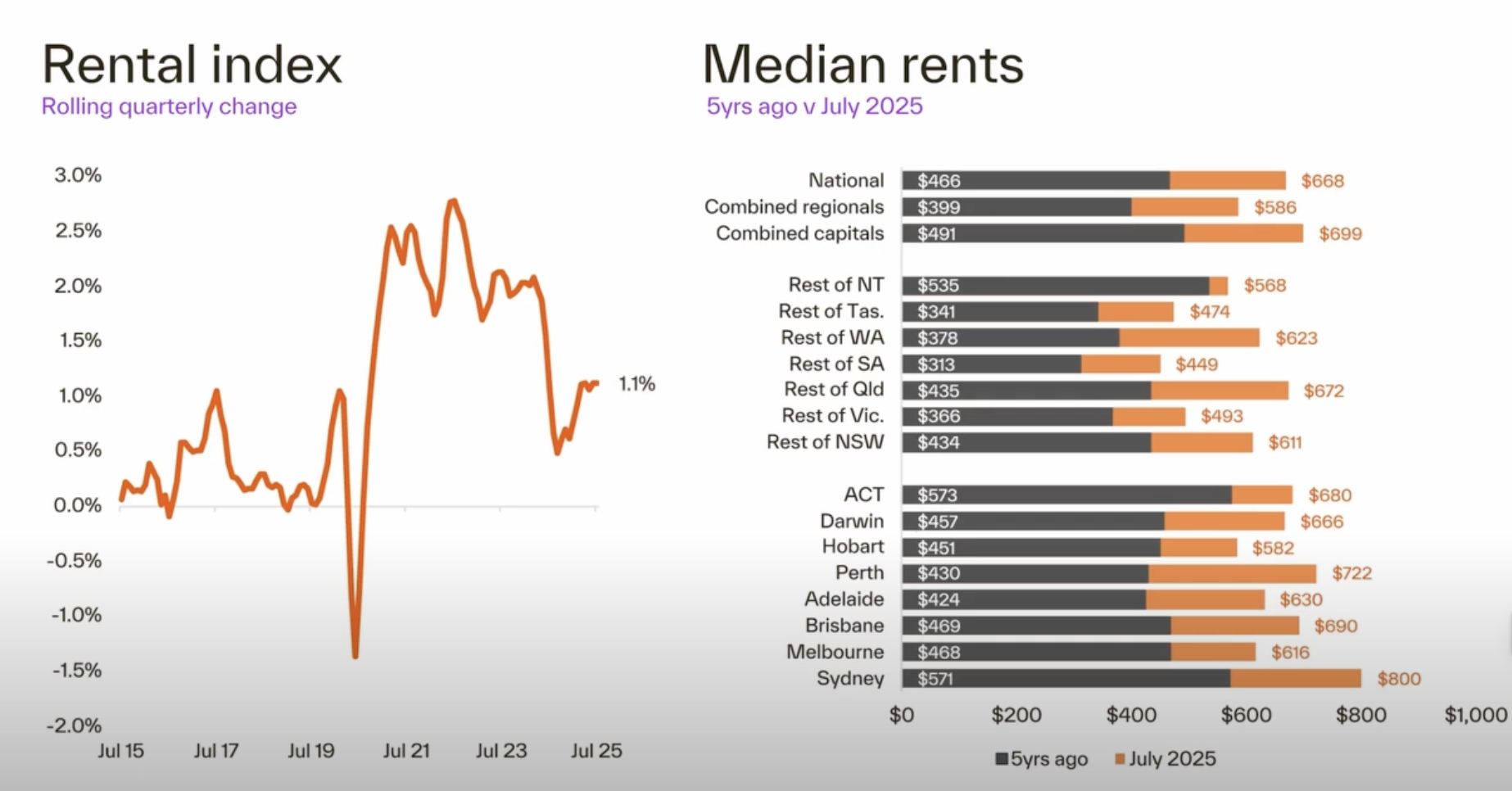

📉 Rents are re-accelerating: up 1.1% nationally over the past 3 months

💡 Affordability remains a key barrier, but low listings and improving sentiment are keeping the market moving

“Every capital city recorded a rise in dwelling values in July.” — Tim Lawless, Head of Research, Cotality

Sydney spotlight:

Detached house values are up 3.3% year-to-date

Unit values have only risen 0.7%

The gap between median house and unit prices in Sydney is now $658,000 — a record-high

Sydney rents rose 0.4% in July — the strongest monthly growth since April 2024

Cotality Home Value Index – July 2025. Source: CoreLogic/Cotality Monthly Report

Cotality Home Value Index – July 2025. Source: CoreLogic/Cotality Monthly Report

🛠️ What’s Happening in Construction (Cotality / Cordell – July 2025)

The July market update includes integrated data from Cordell, Cotality’s construction analytics platform.

While the report was released in July 2025, the construction figures refer to activity recorded in May 2025.

This is not an error — it reflects how construction data is reported:

📊 Construction data naturally lags behind residential market figures because it takes time to confirm planning approvals, funding, and project commencements.

Unlike housing values (updated in near real-time), Cordell’s construction data is based on verified project milestones — meaning May data is the most recent reliable snapshot at the time of publication.

With that in mind, here’s what the Cordell data for May tells us about construction activity feeding into July’s housing pressures:

🏗 1,127 new construction projects were identified in May

🚧 Only 81 moved into construction — down from 207 the year prior

🏘 Apartments/units = just 10.2% of total new project types

📉 Approvals are lagging, especially across multi-unit residential

This helps explain why prices continue rising even as buyer demand is constrained:

There’s simply not enough new housing supply hitting the market.

“It’s hard to see the cumulative shortfall in newly built homes being addressed within the next couple of years — at least.” — Tim Lawless, Cotality

💬 From a Quantity Surveyor’s Perspective

The market feels stable — even promising in places — but that’s not because affordability has improved.

It’s because we’re in a supply squeeze.

And building new housing in Australia still isn’t cheap.

A supply squeeze happens when demand stays strong, but new housing supply is limited - not enough new homes are being built or listed — so the homes that do exist become more expensive to rent or buy, driving up prices and rents.

- 🧱 Slow construction starts

- 🏛 Planning delays

- 👷🏽♂️ Labour shortages

- 🏘️ Few listings or new approvals

📉 This means prices often rise even when buyers are stretched, simply because there aren’t enough homes to go around.

Example:

The median apartment/unit project that entered construction in June was valued at $9.8 million

Assuming 20–25 apartments in that project, this puts base construction cost per unit at $400K–$500K

Add land, compliance, marketing, finance, and developer margin — and you quickly reach $700K–$800K+ sale prices, even for modest-sized apartments

So if you’ve recently bought — or are looking to — it’s important to understand:

You’re not necessarily overpaying. You’re paying the real cost of delivering housing in one of the world’s most expensive construction markets.

🔍 Can Housing Ever Be Cheaper?

Not unless we shift the system itself. Here’s a realistic look:

| Lever | Could It Help? | Realistic Soon? | Barrier |

|---|---|---|---|

| AI or automation | ✅ Yes | ❌ No | Still a hands-on industry |

| Modular/prefab | ✅ Yes | 🔶 Maybe | Not scaled yet in cities |

| Skilled migration | ✅ Yes | ✅ Yes | Politically sensitive |

| Training local workers | ✅ Yes | ❌ Not quickly | Multi-year runway |

| Planning reform | ✅ Yes | ❌ Slow | Council/state politics |

| Mass public housing | ✅ Yes | ❌ Underfunded | Lacks bipartisan support |

| Interest rate cuts | ✅ Short-term | ✅ Yes | Can fuel demand, not supply |

So yes, affordability can improve — but not from waiting.

It’ll take reform, innovation, and commitment from all levels of government and industry.

🧭 What This Means for You

| You Are... | What You Need to Know |

|---|---|

| 🏠 First-home buyer |

Price growth is modest but real. If your finances are strong, acting sooner may beat waiting — especially with so little new housing stock entering the market.

With the RBA delivering a rate cut in August — and banks expected to pass this on — we may see a fresh wave of buyer activity in the coming months. If that happens, today’s modest growth could quickly accelerate as borrowing capacity improves. |

| 🧍🏿♀️ Renter | Rents are rising again. With vacancy rates still tight and new apartment construction lagging, pressure on tenants is likely to persist without significant supply-side change. |

| 🏡 Homeowner | Your equity is stable — and likely strengthening — thanks to low stock and slow new supply. Even modest growth means your property remains well-supported in this market. |

| 🏗️ Small investor/developer | It’s a cautious market, but high demand and low supply could create opportunities for those with sound strategy and strong risk management. Focus on lean, in-demand developments. |

🎙 Final Word

The story in July 2025 is a familiar one:

We’re seeing stable growth.

We’re not building fast enough.

And the cost of building is still a barrier to real affordability.

The smartest decision is not to wait — it’s to act from a place of information, not frustration.

And that’s what I’m here to help with.

✨Free Tools to Help You Move Forward

I believe clarity starts with the right tools. That’s why I’ve created a free resource library for solo buyers and expats.

👉 Start Here – Free Tools

Choose the one that fits you best:

Spend This, Not That™ – smart financial swaps to free up money for what truly matters.

Smart Investing for Expats – make confident decisions with your UK–Australia portfolio.

Review Your Next Contract With Clarity – a checklist to protect yourself before signing.

Download one today and start building clarity and confidence.

Books & Resources That Helped Me Rewire My Financial Thinking

Here are a few books that really helped me shift my mindset and understand money in a healthier, more empowering way:

The Millionaire Next Door – Thomas J. Stanley & William D. Danko (Amazon)

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness – Morgan Housel (Amazon)

Get Out While You Can: Escape The Rat Race - George Marshall (Amazon)

You can also find more resources and books on my blog, including tools I’ve used personally.

👋🏿 Lets Stay Connected: Join My Newsletter - Money & Meaning

If this helped you feel clearer about the property market, subscribe to my newsletter or follow me on LinkedIn. I share monthly wrap-ups, behind-the-scenes project costs, and practical tips for solo homeowners and first-time buyers.

Money & Meaning is my email for independent thinkers designing a life that actually fits — financially, emotionally, and practically.

Each issue includes tools, reflections, and frameworks for navigating life’s most expensive decisions — from buying solo or managing cross-border finances to rethinking work and building financial clarity without the noise.

If you're figuring out how to live well in a world that wasn’t built for your values — this is for you.

🖋️ Related & Other Articles:

How to Protect Yourself When Buying Property With Someone Else: 7 Lessons I Learned the Hard Way

Climate Change and Sydney’s Property Market: The Hidden Factor Driving Prices Up

How I Used Quantity Surveying Skills to Master My Personal Finances

Debt, Discipline & That Magic £15K: How I Built My Emergency Fund (and Started Living on Cash)

UK National Insurance Made Simple: A Guide for Expats in Australia to Secure Their State Pension

Comparing US, UK, and Australian Investments: A Guide for Expats and Savvy Investors

What $9.8m Really Tells Us About Apartment Costs in Australia

📢 Affiliate Disclaimer: Some of the links in this post are affiliate links, which means I may earn a small commission at no extra cost to you if you purchase through them. I only recommend products I trust and believe will add value to my readers.

Disclaimer: This blog post is for general informational purposes only and does not constitute personal financial, legal, or investment advice. The insights provided reflect the author’s personal perspective as a property owner and Quantity Surveyor, and are not tailored to your individual circumstances. You should seek independent, licensed advice before making any financial or property-related decisions.